Is Forex Trading Profitable?

Forex trading has gained immense popularity over the past few decades, attracting both amateur and professional traders from around the globe. With the allure of quick returns and the promise of financial freedom, many wonder: is Forex trading truly profitable? This article will delve into the various aspects of Forex trading, examining its potential for profit as well as the risks involved. For those who seek professional insight and trading solutions, is forex trading profitable Global Trading PK offers a platform to navigate this complex market.

Understanding Forex Trading

Forex, short for foreign exchange, involves the buying and selling of currency pairs with the aim of making a profit. Unlike traditional stock markets, Forex operates 24 hours a day, five days a week, due to its decentralized nature. Traders exchange currencies in pairs, such as the euro against the U.S. dollar (EUR/USD), with the value of each pair fluctuating based on various economic, political, and technical factors.

The Potential for Profit

The potential for profitability in Forex trading is significant, and many traders have reported substantial earnings. Here are some factors that contribute to the profit potential in Forex:

- Leverage: Forex trading allows traders to use leverage, meaning they can control a larger position with a smaller amount of capital. While this can amplify profits, it can also increase risks.

- Market Volatility: The Forex market is known for its volatility, providing opportunities for traders to profit from rapid price movements.

- Diverse Strategies: There are various trading strategies available, such as day trading, swing trading, and scalping, which cater to different risk tolerances and investment goals.

- Accessibility: With the rise of online trading platforms, Forex trading has become more accessible, enabling individuals to participate in the market with relative ease.

The Risks of Forex Trading

Despite the potential for profit, Forex trading is not without its risks. It is essential to understand these risks to approach trading with a balanced perspective:

- Market Risk: Currency values can be highly volatile, and unexpected market events can lead to significant losses.

- Leverage Risk: While leverage can magnify profits, it can also lead to devastating losses if trades do not go as planned. Traders may end up owing more than their initial investment.

- Emotional Trading: The psychological aspects of trading can impact decision-making. Fear and greed can lead to impulsive actions that jeopardize profits.

- Lack of Knowledge: Inexperienced traders may not fully understand the complexities of Forex trading, leading to poor decisions and losses.

Successful Trading Strategies

For traders to enhance their potential for profitability, the development of sound trading strategies is crucial. Here are a few strategies that can help:

- Technical Analysis: Utilizing charts and indicators to analyze price patterns and trends. Technical analysis can help traders make informed decisions based on historical price movements.

- Fundamental Analysis: Evaluating economic indicators, political events, and news releases that can influence currency values. Traders often use fundamental analysis to anticipate market movements.

- Risk Management: Implementing strict risk management techniques such as setting stop-loss orders and position sizing helps protect capital and manage losses.

- Education and Research: Constantly improving one’s trading knowledge and staying updated with market trends is essential for long-term success.

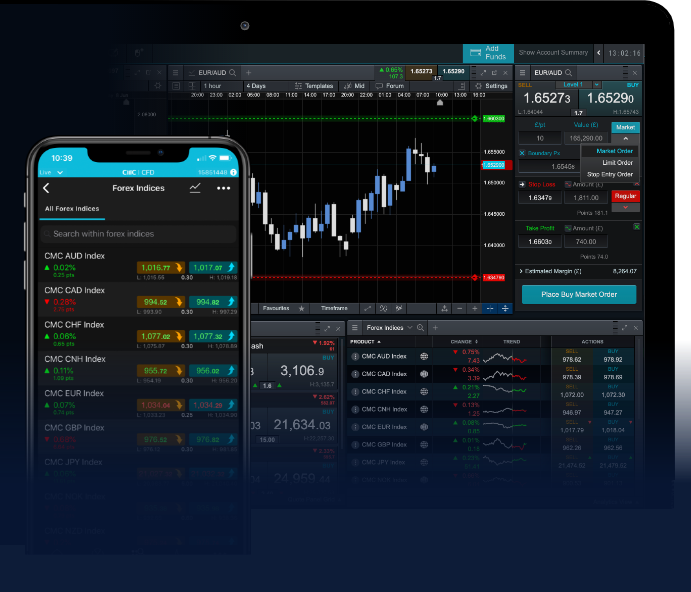

The Role of Technology in Forex Trading

Modern technology has transformed Forex trading, providing traders with tools and resources that enhance their trading experience. The use of trading platforms, mobile applications, and automated trading bots allow for efficient execution of trades and access to real-time market data.

Furthermore, algorithmic trading systems analyze vast amounts of data at lightning speed, enabling traders to seize opportunities that would otherwise go unnoticed. However, it’s essential for traders to understand these technologies and not rely solely on them, as market conditions can change rapidly.

Conclusion: Is Forex Trading Profitable?

In conclusion, Forex trading offers significant profit potential for those willing to invest the time and effort to understand the market. However, it comes with inherent risks that cannot be overlooked. Success in Forex trading requires a solid grasp of market dynamics, a well-defined trading strategy, and the discipline to manage risks effectively. While many traders do achieve profitability, others face challenges that can lead to losses. Therefore, conducting thorough research and possibly seeking guidance from experienced professionals can be invaluable steps for aspiring Forex traders.