The ATR Pocket Option Indicator: A Comprehensive Guide

The ATR Pocket Option Indicator is a vital tool for traders looking to enhance their market analysis and decision-making skills. This indicator allows traders to quantify market volatility and adapt their strategies accordingly. By providing essential insights into price fluctuations, the ATR helps traders to maximize their profits while minimizing risks. If you’re keen on discovering how the ATR can transform your trading experience, check out this ATR Pocket Option Indicator индикатор ATR Pocket Option.

What is the Average True Range (ATR)?

The Average True Range (ATR) is a technical analysis indicator developed by J. Welles Wilder Jr. in the late 1970s. Unlike traditional indicators that focus solely on price direction, the ATR measures market volatility by calculating the average range between the high and low prices over a specified period. This makes it a valuable tool for traders who want to pursue a strategy based on market dynamics rather than just price trends.

How Does the ATR Pocket Option Indicator Work?

The ATR Pocket Option Indicator functions by calculating the average of the true ranges over a designated period. The true range is determined by taking the greatest of the following three values:

- The current high minus the current low

- The absolute value of the current high minus the previous close

- The absolute value of the current low minus the previous close

After calculating these values, the ATR is derived by averaging them over a specific time frame, typically 14 periods. Traders can adjust the period based on their trading strategy and market conditions.

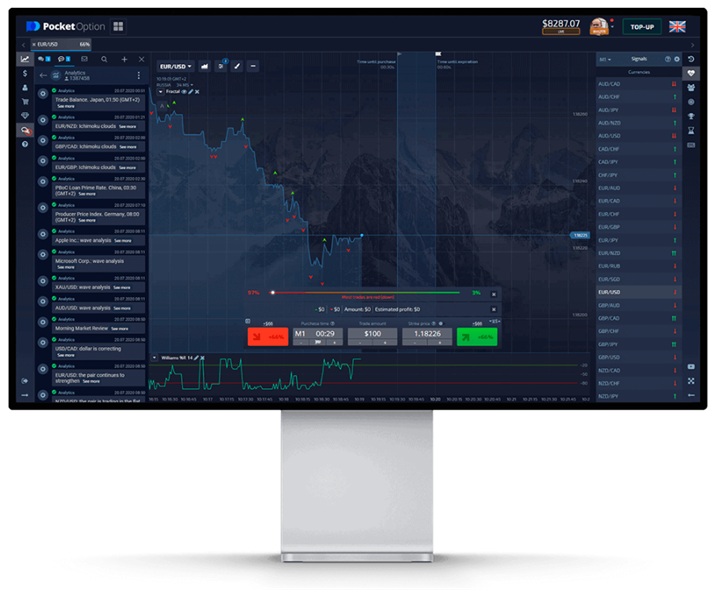

Setting Up the ATR Pocket Option Indicator

To use the ATR Pocket Option Indicator effectively, it needs to be set up correctly on your trading platform. Follow these simple steps to do this:

- Login to your Pocket Option trading account.

- Navigate to the chart where you want to apply the ATR.

- Select “Indicators” from the available menu options.

- Search for “ATR” in the indicators list and add it to your chart.

- Adjust the settings to your preferred period if necessary (default is often set to 14).

Once the ATR is applied to your chart, you will see a line graph that moves up and down based on market volatility. Understanding how to interpret this graph is crucial for leveraging the ATR effectively in your trading strategy.

Interpreting the ATR Indicator

Interpreting the ATR is straightforward. A rising ATR indicates increasing market volatility, while a falling ATR suggests diminishing volatility. Here are some guidelines to help you make sense of the ATR readings:

- High ATR values: Indicate volatile markets, which can signal potential trading opportunities. Traders often look for breakout opportunities during these times.

- Low ATR values: Suggest low volatility and indicate a quiet market phase. Traders may prefer to stand back and avoid high-risk trades in such environments.

- Trend change: A sudden spike in the ATR could indicate a potential trend change, providing traders a chance to either enter a trade or exit an existing position.

Using the ATR for Trading Strategies

The ATR can be integrated into various trading strategies. Here are some popular ways to utilize the ATR Pocket Option Indicator effectively:

1. Trend Following Strategy

Traders can use ATR readings to identify trend strength. When the ATR rises above a certain threshold, it signals strong momentum, and traders may choose to enter positions in the direction of the trend. Conversely, a falling ATR could signal to exit or refrain from entering new positions.

2. Volatility-Based Stop Losses

Another great application of the ATR is to set dynamic stop-loss levels. Instead of using a fixed distance for the stop loss, traders can use a multiple of the ATR. For example, setting the stop loss at 1.5 times the current ATR value allows for recognition of market volatility, adapting to fluctuations that may occur.

3. Range Trading

Traders can utilize ATR to define range-bound trading strategies, particularly in low-volatility environments. When the ATR is low, traders can identify support and resistance levels and look for price to bounce within these levels, leveraging the small price movements for profit.

Limitations of the ATR Indicator

While the ATR Pocket Option Indicator is a powerful tool, it is essential to acknowledge its limitations:

- The ATR does not indicate the direction of price movement. Traders should combine it with other indicators or analyses to confirm trade signals.

- High volatility does not guarantee a favorable price movement; thus, prudent risk management is necessary.

- The ATR is a lagging indicator, which means that it may not react instantly to sudden market changes.

Conclusion

In conclusion, the ATR Pocket Option Indicator is an indispensable tool for traders seeking to understand market dynamics and volatility. By incorporating the ATR into your trading strategy, you can gain valuable insights that will help you make more informed decisions and maximize your trading potential. Remember to use the ATR in conjunction with other indicators and analyses to create a robust trading strategy. As with any trading tool, practice, and patience are key to mastering its use.